How to fill out the FAFSA® form

This article was updated on January 9, 2024.

Written by Dawn Handschuh

Reviewed byÃ˝Chris Conway,Ã˝Director of Financial Education Initiatives and Repayment Management

In this article

Ã˝

Why is the FAFSA form important?

If you want to apply for federal student aid, including grants and loans, then theÃ˝Free Application for Federal Student AidÃ˝(FAFSA¬Æ) form is your new best friend.Ã˝Filling it out correctly can potentially save you thousands of dollars by allowing schools to determine your eligibility forÃ˝grants,Ã˝which don‚Äôt need to be repaid (for students who qualify), and by allowing you to obtain a federal student loan, which offersÃ˝low interest ratesÃ˝and several repayment options.

It is the key, in other words, to knowing how you can pay for college.

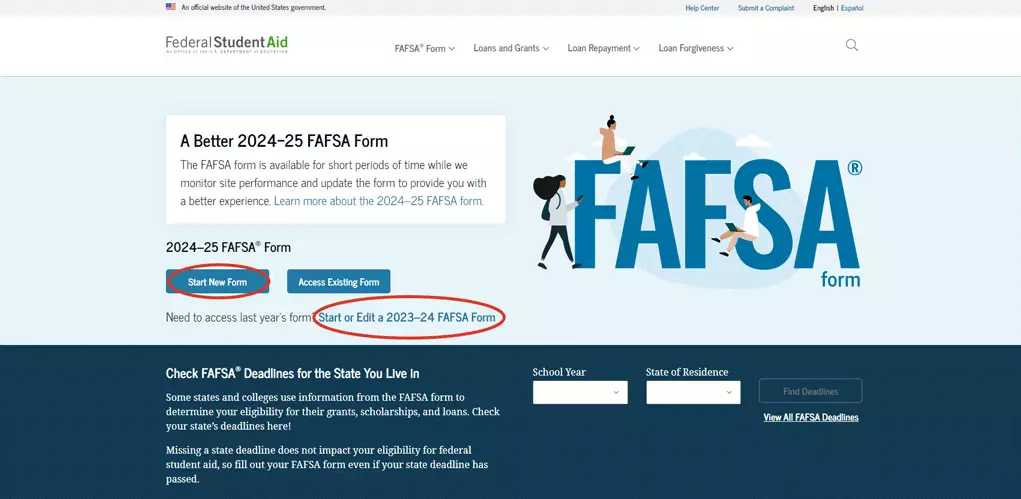

Because filling out the FAFSA form correctly is so important, you need to be prepared. The FAFSA for 2024 has been updated and applies only to the 2024-25 school year, meaning ∆þ…´ ”∆µ students need to use the 2023-24 form for any classes starting before July 1, 2024. (And yes, the 2024 FAFSA form is open!)

So, get your financial information ready and read on for someÃ˝common pitfallsÃ˝andÃ˝best practices.

Avoiding FAFSA fails

How can you mess up your FAFSA form? As it turns out, there’s no shortage of ways!

Mistake #1: Missing the deadline

Don’t …

Wait too long to fill out the FAFSA application. That can lead to missing deadlines established by the federal or state government or by your school of choice.

Do …

Be sure to complete and submit the FAFSA application in a timely manner to meet deadlines.Ã˝Ã˝startingÃ˝Oct. 1Ã˝for the following school year.

The new FAFSA form for the 2024-25 academic year is now available, but you have to choose the right form. Year-round universities like UOPX, for example, will use the 2023-24 FAFSA form for all classes starting before July 1, 2024. Other institutions might have their own policies, and students should check with their schools to determine which FAFSA application to use.

Here's what that looks like:Ã˝

Ã˝

Most students find it easiest to fill it out online, but you can alsoÃ˝Ã˝in English or SpanishÃ˝(or request a printout), complete it by hand and then mail it in.

Keep in mind that each state and each school may have their ownÃ˝Ã˝as well. (And the earlier you apply, the better: Some state grant programs run out of money by the end of the year.)

Mistake #2: Bungling the details

Don’t …

- Create your Federal Student Aid (FSA) IDÃ˝afterÃ˝you begin completing the form. It opens you up to possible processing delays or errors.

- Use nicknamesÃ˝or anything unofficial on your application. It‚Äôs important to list your name and Social Security number exactly as they appear on your Social Security card.

- Pay moneyÃ˝to complete the online form. It‚Äôs not necessary. Be sure you are on the officialÃ˝.

Do …

- Create your FSA account first.Ã˝The username and password you create will make up your FSA ID. Having a FSA ID can simplify signing your form and promissory notes, accessing information and avoiding a common processing error when your verified FAFSA details (name, date of birth and Social Security number) don‚Äôt match information on the form.

- Make sure you fill out the right form.Ã˝Check to see that you have the correct form for the academic year in which you plan to attend school.Ã˝According to Chris Conway, director of financial literacy at ∆þ…´ ”∆µ, there are usually two FAFSA forms accessible on the FAFSA website at a time.

“Simply put, the form you fill out should align with the school year you’re seeking aid for,” Conway explains.

For instance, the 2023-24 federal award year runs from July 1, 2023, through June 30, 2024. ‚ÄúAsk the financial aid team at your college if you‚Äôre unsure which form you should use,‚Äù Conway adds. ‚ÄúFor example, at ∆þ…´ ”∆µ, we provide a notification in the student portal.‚Äù

Mistake #3: Not being prepared

Don’t …

Mail your financial documents to the U.S. Department of Education. You need them to complete the FAFSA application, but you don’t send them to the U.S. Department of Education.

Do …

Collect your paperwork ahead of time.Ã˝Completing the FAFSA application will go more smoothly if you have the following ready:

1. Driver’s license

2. Alien registration number if you’re not a U.S. citizen

3. Past tax returns, including W-2s (depending on which FAFSA application you use, you may not need this, but it’s good to have just in case)

4. Details on any untaxed income like child support, interest and veterans’ non-education benefits

5. Details on checking and savings account balances and investments, including real estate (but not your primary residence)

FAFSA best practices

It’s not enough to avoid mistakes. Here are some best practices for getting it right the first time.

Take your time

Read all questions and instructions carefully, paying close attention to definitions of certain terms, including:

- Parents

- Legal guardianship

- Number of family members

- Net worth of investments

- Taxable college grants and scholarships

You‚Äôll also need to assess whether you‚ÄôreÃ˝a dependent or independent studentÃ˝in a designated section of the FAFSA application.Ã˝Dependent studentsÃ˝must provide their parents‚Äô financial information as well as their own so that their eligibility for financial aid can be determined.

Independent studentsÃ˝must report their own information and, if married, that of their spouse. (Ã˝can be found online.)

Keep in mind that the FAFSA definition of what is considered a dependent student isÃ˝separate from IRS dependency guidelines. You may still be defined as a dependent student for FAFSA purposes even if you file your own taxes and pay your own bills. If FAFSA determines that you are a dependent student but you haven‚Äôt provided your parents‚Äô information,‚ÄØyour form may not be processed and you may not be eligible for financial aid.

Another major change with the 2024-25 FAFSA form is a semantic one: What was formerly known as the Estimated Family Contribution (EFC) has been renamed and reformulated as the .

The goal of the SAI is to more accurately assess aid eligibility in a more streamlined fashion. Some applicants, for example, may have to answer as few as 18 questions to determine their SAI.

Unlike the EFC, the SAI can be a negative number all the way down to -1,500. And that’s a good thing: A negative SAI could mean more eligibility for Pell Grants. An from low-income backgrounds will be eligible for Pell Grants with this new calculation.

Report any changes to income or marital status

If your financial situation has changed significantly since filing your tax return (think job loss, divorce or marriage), it‚Äôs possible to have yourÃ˝financial aid adjusted. Complete the form and submit it as you normally would, then contact the school you plan to attend and explain how your financial situation has changed.

It’s important to update as necessary because a change in marital or financial status could mean a change in your aid award.

If you need to make a correction, simply log in to the FAFSA homepage, go to your online form and then choose ‚ÄúMake Corrections.‚Äù You canÃ˝correct any fieldÃ˝except for your Social Security number.

If you wish toÃ˝add a schoolÃ˝after your FAFSA form has been processed, you can log in and, on the My FAFSA page, select Add/Change Schools and then follow the instructions to submit your revisions.

Take advantage of technology

TheÃ˝IRS Data Retrieval Tool (DRT)Ã˝automatically transferred your tax details into the FAFSA form and, up until the new FAFSA form, it was optional. For those still working off the old FAFSA form, it‚Äôs a good idea to use this option, since itÃ˝saves time,Ã˝eliminates mistakesÃ˝and potentiallyÃ˝reduces the amount of paperworkÃ˝you may need to submit to your school later.

The new FAFSA form leverages a mandatory IRS Direct Data Exchange feature. Any “contributor” (this includes parents for dependent students and spouses, when applicable) will be invited through email to provide their tax information using this tool. In order for a student to be eligible for aid, they need an SAI, which is calculated using contributor (and the student’s) tax information.

Using the Direct Data Exchange, in other words, is essential for completing the new FAFSA form. If a contributor does not provide consent when completing their portion of a FAFSA form, the student will be ineligible for federal student aid.Ã˝

Pay attention to college order

You’ll need to list at least one college when you complete the FAFSA application, and you can add up to 20 colleges when applying online using the 2024-25 FAFSA form. The 2023-24 form allows up to 10 colleges to be added.

The schools you’re considering attending will need the FAFSA form to determine whether you’re eligible for federal student aid and, if so, how much. Colleges can’t see the other schools you are applying to.

So, list your desired schools in the right order. Some states may require you to list at least one eligible in-state school if you are applying for state aid. For example, in Massachusetts, Michigan, Pennsylvania and West Virginia, state grant awards are made to the first in-state college listed on your FAFSA application.

, like South Carolina and Vermont, specifically request you put the schools you’re most likely to attend at the top of your list. Include all schools you are interested in, whether or not you have applied yet.

However, each state may have different criteria or guidelines that need to be followed to be considered for their state grant programs. As such, if you are interested in applying for state grants that are available in your state, it is important to check with your state grant issuing agency.

Sign on the dotted line

One very common mistake, after painstakingly completing every section of the FAFSA form, is neglecting to sign your form with your FSA ID and submitting it!

Once you see the confirmation, you’ll know the form has been successfully submitted. Whew! Don’t forget to check your email (and spam folder) for any messages concerning your financial aid.

Just to be safe, you may want to print a copy of the online confirmation since it provides some details not shown in the email confirmation.

Filling out the FAFSA form may not be rewarding in the moment, but the potential savings on your college education absolutely are.

ABOUT THE AUTHOR

Dawn Handschuh has been putting pen to paper for more than 30 years, writing widely on topics related to student lending, personal finances, everyday money management and retirement planning. She makes her home in Connecticut with her husband and two energetic German shepherds.

ABOUT THE REVIEWER

As Director of Financial Education Initiatives and Repayment Management,Ã˝Chris Conway works with departments across the University to provide resources that allow students to make more informed financial decisions. She is also an adjunct faculty member for the Everyday Finance and Economics course at the University, and she chairs the National Council of Higher Education Resources College Access and Success Committee. Conway is committed to helping college students make the right financial decisions that prevent future collection activity.

This article has been vetted by ∆þ…´ ”∆µ's editorial advisory committee.Ã˝

Read more about our editorial process.

Read more articles like this: